The Toxic Impacts of Venture Capital on Psychotherapy

Summary

Can psychotherapists maintain patient-centered ethics and standards of care if they choose venture capital (VC) employers? Can psychotherapists entrust their license and reputation to a VC company?

Will psychotherapists, contracted by billion-dollar VC funded companies abandon responsibility for the care they provide? Do contracted psychotherapists realize they maintain personal liability when they let the VC company manage client care?

A billions-of-dollars VC company needs to contract/employ 100,000 psychotherapists in order to make a profit or to sell it!

Mental health VC can’t just be successful, they have to WIN BIG, or they fail because of the hyped investor expectations they have created.

VC companies cannot afford to believe in psychotherapists’ ethics, values or the importance of the relationships created with clients. Such words are just “packaging” in the language of these big-dollar ventures.

Billion dollar companies and private practice therapists now compete for the same patients. VC companies have marketing and advertising resources private practice therapists do not.

Can VC increase access to care, improve outcomes, coordinate care with physicians and make a fortune at the same time? What happens to patients when a VC company fails or is sold to prevent failure? Many will be sold.

VC will not hesitate to create policies that inflect moral injuries on patients and psychotherapy providers, the likes of which should be taken seriously before signing any agreement to work for them.

VC are convincing Healthplans they can manage every aspect of psychotherapy practice, asserting that their technology and management strategies will dramatically improve outcomes. They assert that the management demands they place on psychotherapists will save millions of dollars.

The increase in value the VC companies promise their investors depends upon convincing therapists to leave independent practices or small contracted-employee groups and join VC companies that will either fail or be sold to another company or a Healthplan.

Some VC companies have purchased and will purchase contracted-employee groups, with the intent to aggregate the services of clinicians in those groups for the VC companies’ increased profits.

Over the past 20+ years, most Healthplans have failed to provide costs of living or cost of practice increases in psychotherapists’ compensation. A modest 1.5% increase per year would have yielded 35% increase in psychotherapists’ incomes.

One primary reason psychotherapists have not adopted alternative payment methods (APM) is that they cannot afford to so. For the past 5 years 3 large Healthplans in Oregon have wanted APMs created by private practice professionals but would not compensate providers for the necessary costs of organization and administration.

Healthplans insist on hard data to demonstrate the value of services. They are not reassured by research that repeatedly confirms the value of psychotherapy. They compete with each other. They need data to sell their plans to employers.

Independent psychotherapists are hard pressed to invest in technology and processes that take time away from direct service to their patients.

Collaborative groups of independent practitioners which include solo and small group practices can survive and thrive by sharing technology and marketing costs. Professional organizations like IMHPA are paving the way to services that meet ACA criteria and preserve autonomy for psychotherapists.

Psychotherapists who understand that psychotherapy must be centered on the individual circumstance of each patient also recognize that a healthy patient-therapist alliance is the most important factor in the outcome of care. VC is concerned about packaging, not providers and the relationship with their patients

Healthplans and VC companies believe investments of billions of dollars will make Healthplans and VC companies huge profits. The only way that can happen will be for Healthplans and VC companies to take control of psychotherapy services and reduce psychotherapist fees-for-service and/or demand high treatment volume.

What is a Venture Capital Company (VC)?

It is fair to say that most venture capital companies are, in many respects, “Ponzi Schemes.”

A Ponzi Scheme is a financial fraud that lures people to invest and and pays “profits” to early investors with funds from new investors. Such schemes lead victims to believe the profits are coming from some legitimate business activity. New investors are unaware that former investors are the source of the supposed “profits”.

VC companies in the mental health arena are focused on rapid growth. VCs are focused on making money for their investors; they are not invested in clinical excellence, values, or cause. Those elements are just “packaging”. VC funds offer high-risk for high-reward. They receive their funds from investors (limited partners or LPs) that seek to outperform safer investment options.

It is not enough for a VC fund to be in the green to count as successful. It is not enough for a VC funds to have a startup succeed. VC investors NEED it to succeed BIG. They need each venture to double their money or more because many of the startups in a VC investors portfolio will inevitably underperform.

For more information see:

Venture Capital

How much is being invested by VC in digital health and behavioral healthcare?

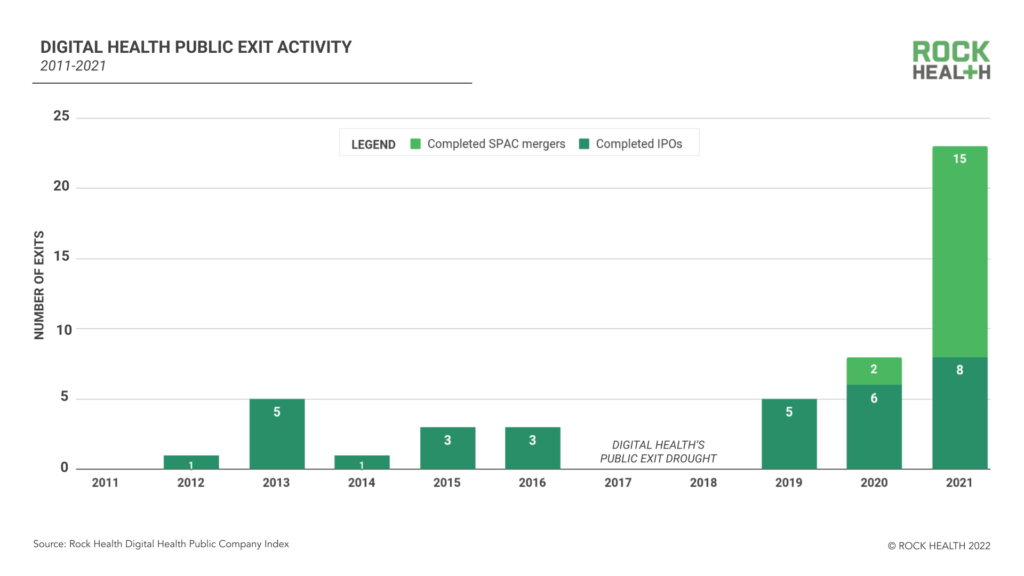

The amount of VC money invested in start-ups and existing start-ups in 2021 is much higher that illustrated in the Figure 1z and Figure 1b.

Figure 1a

Figure 1b.

What are mental health “unicorns”?

The face and dark shadow of Venture Capital

According to the American Psychoplogical Asociation (APA) venture funding is pushing technologies to a central spot in the mental health landscape. APA believes there is opportunity to ensure that these interventions are ethical, inclusive, live up to their claims, and help people get better.

Unicorn is the term used in the venture capital industry to describe a startup company with a value of over $1 billion. The term was first coined by venture capitalist Aileen Lee in 2013.

According to Investopedia, Valuation is a quantitative process of determining the fair value of an asset or a firm. In general, a company can be valued on its own on an absolute basis, or else on a relative basis compared to other similar companies or assets. There are several methods and techniques for arriving at a valuation—each of which may produce a different value. Valuations can be quickly impacted by corporate earnings or economic events that force analysts to retool their valuation models.

For more information see:

Investopedia.com

Valuation of Eight mental health start-up unicorns

Lyra Health $5.85 billion

Cerebral $4.8 billion

Ginger $3.1 billion

Genoa $2.5 billion

Modern Health $1.2 billion

Calm $2 billion

Talkspace $1.4 billion

Modern Health $1.2 billion

For more current information see:

CrunchBase.com

There is a dark side to venture capital. Initially aligned with founders, the shadow of VC is greedy and toxic, pressuring psychotherapists to risk their license in order to achieve greater return on their investment, selling the company, and then moving on to the next venture. VC business practices are often unpredictable. For example, VC investors can:

block new financing because they don’t want to lose rights.

collude with new investors to optimize the terms of a new round of financing.

hold out for a 1% potential of high valuation vs. getting 1.5 fold their money and letting founders take some cash and move on to the next thing.

scale the business too quickly creating the appearance of rapid growth to enlist more funding.

reduce fee-for-service, shorten duration of treatment, or divert patients to less expensive coaching and education apps.

Founders can become problematic by:

wanting to sell the company, and fighting investors opposing the sale because they’ve not yet realized the “full potential” of their investment.

wanting to sell the company before it fails and confronting VC when they block the sale because it might be perceived as a “failure” for their portfolio.

What are the value propositions and challenges facing a VC funded behavioral health company?

Thomas R. Insel, MD wrote an article entitled What’s next for digital mental health companies? Dr. Insel is well known for taking the position, as the Director of The National Institute of Mental Health, that the Diagnostic and Statistical Manual (DSM) of the American Psychiatric Association has no scientific value and that psychiatric medications are not the answer to mental health problems in the US.

In 2021 the total funding among US-based digital health startups was $29.1B across 729 deals, with an average deal size of $39.9M. Overall investment nearly doubled 2020’s $14.9B.

Digital mental health VC companies are more and more big tech companies with $5.1 billion in venture capital investment in 2021. The valuations are in excess of 20 billion dollars.

Insel questions whether or not the economic valuation will match their impact and clinical value.

Insel also raised 3 issues.

Any visitor to a public or private mental health facility finds little attention to the patient’s journey, and even less concern for the needs of families.

As with every other aspect of medicine, better quality will require training providers in evidence-based care, measuring results of treatment, and improving practice based on this feedback — none of which has been standard in traditional mental health care.

Digital mental health companies should incentivize getting results rather than keeping people in therapy. Value-based payment, which will depend upon the ability to better measure outcomes, is still aspirational in mental health. The culture of tech companies can point the way to solutions here as well. These companies are, of course, focused on accountability to their boards and shareholders. But their execution strategies are defined by objectives and key results or some similar, detailed plan for demanding internal accountability.

For more information see:

What’s next for digital mental health companies?

The 11 propositions below describe what Healthplans face and why they are willing to buy into the current VC disruption of psychotherapy practice:

The rates for anxiety and depression among U.S. adults increased from 11% in 2019 to 42% in December 2020. During August 2020–February 2021, the percentage of adults with recent symptoms of an anxiety or a depressive disorder increased from 36.4% to 41.5%, and the percentage of those reporting an unmet mental health care need increased from 9.2% to 11.7%. The overall demand has increased by more than 50% during the pandemic.

There are not enough psychotherapists available to meet new demands for treatment of stress, depression, anxiety, adjustment disorders, not to say anything of trauma, isolation and fear.

Healthplans that make low reimbursements for psychotherapy are faced with having to increase their fees-for-services to compete with Healthplans that pay more.

For every dollar spent on mental health services, Healthplans save more than 7 dollars. Employers want value-based purchasing options when they contract with Healthplans. This requires health plans to adopt alternative payment methods (APM) for psychotherapy services.

Healthplans that pay less cannot create value and improve outcomes without paying psychotherapists more. Healthplans want to pay psychotherapists less, not more.

In general, patients achieve nearly 50% improvement from psychotherapy in 8 to 10 sessions. Improvement from each appointment diminishes significantly by appointment 14. A small percentage of patients continue therapy beyond 20 sessions and those patients generally make smaller measurable gains with each extended-care appointment.

Some therapy patients need extended-care psychotherapy just like some medical patients need dialysis.

Healthplans have generally refused to increase reimbursements to mental health professionals, often ignoring the importance of cost of living and cost to practice increases. Over a 20 year period, Healthplans failed to provide even 1.5% increase per year for cost of living and cost to practice which would have yielded a 35% increase in psychotherapists’ income. That is the technology debt that private practice resolve in order private practice psychotherapy to continue.

Private practice psychotherapists are usually not aligned, affiliated, or collaborative with other therapists and often do not have shared standards for their practices. Many do not coordinate with primary medical care. Physicians must find referrals for patients who need behavioral or mental health services.

Healthplans, who have relied on utilization review and low reimbursement rates for psychotherapy services to hold down the costs of mental health care and access to that care, have failed to support innovations and improvement at the independent practice level of care.

The digital power of VC companies is disrupting the practice of psychotherapy, intending to divide psychotherapists who are focused on quality from those who primarily want to make more money.

Will psychotherapists do better work if they are employed and managed by multi-billion dollar VC funded companies?

Psychotherapists can always do better. But, can they make miraculous improvements in their outcomes with patients? The graph below reflects research replicated over several decades. Healthplans and VC investors are well aware that psychotherapy has the most measurable benefit early in treatment and diminishing “improvement” over time. An estimated 70% to 75% of patients experience symptom improvement and terminate treatment before or at about appointment 14.

Psychotherapists should carefully consider whether joining a VC company is participation in a Ponzi Scheme that may fail to dramatically improve outcomes or reduce medical costs. Or, that VC company could reduce psychotherapy fees, hire troops of behavioral health coaches, and medicate as many patients as possible.

Figure 2 is a diagram that depicts how quickly patients improve. The percentage of reliable improvement is a logarithmic function that varies based on the case mix and severity of problems. Figure 2 reflects rates of improvement for acute problems like adjustment disorder and uncomplicated depression and anxiety. Case-mix severity and complexity can be used to predict shorter or longer episodes of care.

Figure 2

How do VC investors profit in the psychotherapy space?

Venture capital investors will profit only if they can:

Create a value proposition that attracts investors.

Hire managers and administrators who increase the valuation of the company.

Attract clients to their digital platform.

Require therapists to consistently carry high caseloads.

Control patients’ ability to access their therapists.

Control therapists’ ability to access their patients.

Control treatment plans.

Contract with psychotherapists who accept both responsibility and liability.

What do VC investors want from psychotherapists?

In order to get referrals psychotherapists must be prepared for intensive VC management of treatment to increase the company’s profit and valuation.

This will be accomplished using frequent internal audits to control:

The duration of care (i.e., episode of care).

Treatment modalities (wellness coaching, group therapy, individual therapy).

Use of 90837 and 90839 CPT codes.

Frequency of appointments (weekly, bi-weekly, monthly, bi-monthly).

Psychotherapists’ use of screening, progress, outcome, and satisfaction measures.

What is the expected return on VC investments?

The expected return for venture capital investors requires Healthplans to contract with these new digital-platform “therapy companies” complete with their contracted, compliant therapists - whose cumulative screening, progress, outcome, and satisfaction measures will demonstrate the enormous savings in medical costs that can be achieved for Healthplans by brief measured episodes of treatment.

Despite Healthplans denying mental health professionals cost of living or cost of practice reimbursement increases, small groups of independent psychotherapists have invested in organizing, measurement systems, and training. These groups have been encouraged by Healthplans to develop measurement based care processes. However, no measurement based care models based on provider-patient centric relationship have yet been offered contracts.

Rather than being patient-centric, venture capital funded companies have become managed care companies with more restrictive policies than the healthplan managed-care policies of the 1970’s and 80’s. And, healthplans are now seek and implement Outcome Informed Care (OIC) models that are disruptive to the patient-therapist alliance because the measures required are intrusive rather than clinically useful.

Digital venture capital companies bring no clinical value to psychotherapy. They bring financial value to Healthplans by gathering numbers of providers who accept the companies’ data management structure, which denies them capacity to gather and learn from the patient screening, progress, outcome and satisfaction data of the people to whom they provide care.

Table 1 reflects findings that more than 2/3rds of patients have substantially improved and discontinue treatment between session 14 and 25. These results have been replicated in various forms and studies as far back as Howard’s landmark research in 1986.

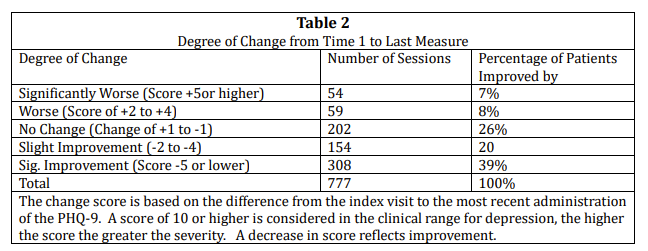

Table 2 data from several clinics in which mental health professionals routinely used the PHQ-9 to obtain patient reported outcomes on depressive symptoms. Without case mix or session data it is difficult to compare it to “baseline” data, but the degree of change appears to reflect outcomes below what might be expected for common outpatient therapy. Thus, data can serve as means to explore the interventions and alternatives that can improve care.

Decades of research demonstrate that providing 10 to 14 appointments will significantly improve the symptoms for approximately 75% of patients.

To maximize health care savings, the VC companies focus therapists’ treatment on:

The reduction of symptoms that present to physicians in primary care with no physical cause (e.g., somatization, trauma, depression, anxiety, panic, etc.)

Reducing medical and psychiatric hospital visits and admissions for anxiety, depression and panic disorders by referring more patients to psychotherapists after hospitalization.

Constraining psychotherapy to 3 to 14 appointments as often as possible, focusing on physical symptom reduction.

Compelling psychotherapists to provide evidence of medical necessity for care when any episode of care exceeds 20 appointments.

A depressed person has an average of $6,390 more in healthcare costs than a non-depressed person each year. The value proposition that digital platforms will save billion of dollars is based on pre-pandemic data which show that a Healthplan can save between $700 and $1300 in medical costs per patient after the psychotherapist is paid for their services. One thousand therapists treating 25 patients each can save a Healthplan nearly 20 million dollars in healthcare costs. Focusing on quickly treated conditions such as uncomplicated anxiety and depression means major savings for Healthplans.

Are VC digital platforms devaluing psychotherapy?

VC companies seem to be doing everything they can to lure patients to their platforms; causing damage to the reputation of psychotherapy in the process.

The following is drawn from an article with links published by Mental Health Match on May 23, 2021.

BetterHelp pays therapists for messages that are limited to less than twice the word count of the message written by their client. As one exasperated therapist wrote, if a client says, “‘I feel like giving up,’ I have 10 words with which to respond to that or I will be out of compliance and I will not be paid for my work.”

Talkspace pays therapists by the word for text messages—incentivizing quantity over quality and depth. Therapists who don’t respond to an incoming message quickly enough have their pay docked. What matters most in these companies is quick client gratification instead of growth, recurring revenue instead of improved outcomes.

Talkspace asked therapists to provide therapy in states they weren’t licensed to practice in, offering to cover their legal fees if they ad to defend their license to their state board.

AbleTo, told clients “Progress Guaranteed,” a statement that violates ethics rules for any individual therapist, and an expectation that therapists might not even know their clients have—even though the legal and ethical liability for meeting those expectations falls on the provider. (Since the Mental Health Match article was published, AbleTo removed this unethical “guarantee” from their website.)

Ginger, a mental health platform sold to employers, promises they can work with “any challenge”, “anytime”, “anywhere”, even though their on-demand platform is staffed by unlicensed coaches who can earn a coaching certification in just a few days of online training. Coaches can be helpful resources, but they are currently marketed in ways that don’t acknowledge their limitations.

For more information see:

Is This the End of the Private Practice Therapist?

Examples from an article published by the American Mental Health Alliance on January 27, 2022.

Cerebral, a 4.8 billion dollar mental health VC digital platform that proposes a solution that has little clinical value, solves problems that may not exist, and creates legal problems for psychotherapists. Cerebral intends to manage every aspect of psychotherapy practice, as if that will improve outcomes. Additionally, they intend to place additional burdens on psychotherapists that are supposed to save millions of dollars over current psychotherapy practice capabilities and cost. Cerebral’ s telehealth platform (they say) provides an online screening and health questionnaire that automatically matches patients with the most appropriate care team and plan based on patient preference and clinical need.

Cerebral clinicians receive personalized monthly audit reports that include written feedback, patient ratings of care, patient’s adherence to care, clinical outcomes, patient engagement levels, use of smartphone app, adherence to appointments and treatment plans, wait times for appointments, response times to patient outreach, and patient satisfaction. The monthly audit also assesses the quality of clinical reasoning and completeness of documentation.

Headway is a practice management service and network builder organization that offers services to therapists such as contract application and administration processes, billing services, screening, outcome measures, referrals and guaranteed payment in exchange for accepting Headway’s contract with a Healthplan. Psychotherapists are contracted employees. In Oregon, Headway campaigned to recruit providers who were close to retirement offering to provide administrative services to reduce providers’ overhead. At the time this article was published, Headway offers a $300 “headhunter-fee” to Headway providers who refers other providers who join their network.

Reliant Behavioral Health (RBH) has more than 2000 private practice professionals organized into what they market as a “network for rent.'“ They misled providers by suggesting that RBH is an independent practice organization (IPA).

While there is no legal definition of an IPA in Oregon, RBH is a for-profit pass-through corporation which credentials the providers, does not negotiate on behalf of providers, and only offers contracts to members of their network. RBH is paid by the Healthplan for contracts.

For More information see:

Threats to Psychotherapy Practice and Patient Privacy

Can private practice psychotherapists compete with billion dollar companies?

Companies claiming “value” of more than a billion dollars are now competing for the same clients as small private practices, and they are doing so with tools and resources unavailable to individual therapists. This economic imbalance might not be apparent during a pandemic when the demand for therapy has increased so quickly. When demand settles, therapists will discover that VC marketing and competition have changed the way they need to practice. At the same time, the reputation of psychotherapy as a profession, will be damaged.

Clients who engage with a therapist who is not be a good fit for them quit because there has been no relationship building to help them understand how therapy works or what they might expect from it. Clients who have such experience end up with a negative perception of therapy.

Many clients will have negative experiences using VC digital platforms. It may be their first and last time considering therapy.

Figure 3

Private psychotherapy cannot compete with multi-billion dollar companies except in the short term. Figure 3 is an diagram the illustrates the Pareto Principle and Price’s law, which offer a mathematical model to characterize competition among providers of goods and services. Assume for a moment that there are 100,000 psychotherapy providers. The square root of those providers is 316. That is the number of providers who organize and find a way to serve 50% of the mental health clients. That is one reason why VC exists. The 99,683 individual psychotherapists, who are not part of an organized group, will compete for the other 50% of clients. This mathematical model is based on a finding that providers of goods and services form companies to be more efficient and increase profits. Collaborative groups of independent practitioners which include solo and small group practices can survive and thrive by sharing technology and marketing costs.

For more information see:

Threats to Psychotherapy Practice and Patient Privacy

Survive and Thrive in Private Mental Health Practice

How are Billion Dollar Companies Recruiting Psychotherapists?

Healthplans are negotiating with and contracting with venture VC led companies in order to entice psychotherapists into canceling their existing contracts and/or to allow their company to manage their practice. Marketing to grow VC provider networks are being accelerated by marketing strategies which include:

Bait-and-switch recruitment practices.

Seemingly lucrative contract offers.

Promises of practice management, billing and administrative support services.

Bonuses for provider referral of more new providers.

Signing bonuses.

Setting appointments in the psychotherapist’s calendar.

Increasing the number of patients your (but reducing your base fee-for-service)

Managing psychotherapists billing and revenue cycle management (depositing payments to providers weekly).

Building provider networks and ‘flipping’ those networks to larger companies (or to networks for rent).

Requiring patients to pay for one venture company’s referral service in order to find low cost providers and to encourage Healthplans to contract with that venture capital company.

Creation of “ghost” networks by venture capital companies that can limit access and services in ways that may shield Healthplans from accountability to their state health authorities or insurance commissions.

Requiring providers to use specific measurement systems that give visibility into providers’ and patients’ health information data base (data worth millions to Healthplans).

Creating contracts with very part-time providers in order to create the appearance of a referral network so Healthplans will contract with these commercial managed care networks.

More…

For more information see:

Threats to Psychotherapy Practice and Patient Privacy

Do psychotherapists want to work for a billion dollar company that contracts with 80,000 psychotherapists and manages all client interaction?

If Psychotherapists adopt outcome informed care (OIC) treatment methodology mental health professionals can join the larger health care community; obtaining information from patients regarding their symptoms, functioning, well-being, health behaviors and experience of care. All of this is required to meet the patient services criteria of the Affordable Care Act. OIC offers both the flexibility and meaningfulness of standardized scales and facilitates communication with other health care professions consistent with medical use of patient reported outcome measures (PROM) and outcome informed care (OIC).

Psychotherapists will be wise, if they want to remain independent and private, to develop habits of comprehensive symptom and problem assessment and systematic follow up. This, combined with patient alliance skills will improve client satisfaction, clinical outcomes, reduce overall medical costs, and improve communication with other health care professionals. It will also counter the argument that independent private practice psychotherapists provide no significant accountable value.

Psychotherapists should carefully consider their value to Healthplans, recognizing that Healthplans don’t want to acknowledge that therapist services and the data concerning their interventions have a huge impact on Healthplans’ future ability to contract with employers. Psychotherapists’ value is not only the millions of dollars their work can save in healthcare costs, it includes the value of the data that demonstrates effective care, which VC companies would sell to Healthplans and their investors.

For now, it seems Healthplans assume that psychotherapists are incapable of collaboration and of demonstrating their valuable outcomes through collaboration.

VC companies promote that investment of billions of dollars will lead to huge profits for Healthplans and VC investors. The only way that can happen will be for VC companies take control of all elements of mental health service, reduce psychotherapists fees-for-service, and demand high caseloads. That is exactly what Cerebral, Lyra Health, and all the all the other unicorns are doing.

Collaborative groups of independent practitioners which include solo and small group practices can survive and thrive by sharing technology and marketing costs. Professional organizations like AMHA-OR are paving the way to services that meet ACA criteria and preserve autonomy for psychotherapists.

References

Caution: Direct-to-Consumer Digital Care – All That Glitters Is Not Gold. December 9, 2021. Telebehavioral Health Institute. https://telehealth.org/digital-care/

Do Venture-Capital Investors Think Psychotherapists are Dumb? American Mental Health Alliance. January 2022. https://www.amha-or.com/are-psychotherapists-dumb

Impact of Behavioral Health Treatment on Total Cost of Care Study. https://www.evernorth.com/behavioral-health-study

Is This the End of the Private Practice Therapist? May 23, 2021. Mental Health Match. https://mentalhealthmatch.com/articles/for-therapists/end-private-practice-therapist

Mental health, meet venture capital. January 1, 2022. American Psychological Association. https://www.apa.org/monitor/2022/01/special-venture-capital

Symptoms of Anxiety or Depressive Disorder and Use of Mental Health Care Among Adults During the COVID-19 Pandemic — United States, August 2020–February 2021. April 2, 2021. CDC. https://www.cdc.gov/mmwr/volumes/70/wr/mm7013e2.htm

Telehealth proves its worth. January 1, 2022. American Psychological Association. https://www.apa.org/monitor/2022/01/special-telehealth-worth

Telehealth use drops for 3rd straight month as patients return to in-person appointments. July 2, 2021. Fierce Healthcare. https://www.fiercehealthcare.com/tech/telehealth-use-drops-for-third-straight-month-as-patients-return-to-person-appointments

The Rise of Venture Capital Investing in Mental Health. September 2, 2020

https://jamanetwork.com/journals/jamapsychiatry/article-abstract/2770792The State of Mental Health in America. https://www.mhanational.org/issues/state-mental-health-america

Millions of Americans Are Turning to Therapy, and Investors See an Opportunity. The Wall Street Journal, 2022. https://www.wsj.com/articles/as-demand-for-mental-health-care-booms-investors-see-opportunities-11652018401

VC’s Add Mental Health Services to Their Value Add Propositions, February 4, 2020. Venture Capital Journal.

https://www.venturecapitaljournal.com/vcs-add-mental-health-services-to-their-value-add-propositions/Venture Funding For Mental Health Startups Hits Record High As Anxiety, Depression Skyrocket, June 7, 2021. Forbes Magazine.

https://www.forbes.com/sites/katiejennings/2021/06/07/venture-funding-for-mental-health-startups-hits-record-high-as-anxiety-depression-skyrocket/?sh=3e553aa61116What’s next for digital mental health?

https://www.statnews.com/2022/02/02/whats-next-for-digital-mental-health-companies/